colorado electric vehicle tax credit 2019

Vehicle Conversion 1 and 1A Electric Vehicle or Plug-in Hybrid Electric Vehicle Light Duty Passenger Vehicle 5000 2500 5000 7 and 7A Electric Truck or Plug-in Hybrid Electric. The Colorado state tax credit will.

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Fiscal Policy Taxes.

. At least 50 of the qualified vehicles. Income tax - credit - innovative motor vehicles. November 17 2020 by electricridecolorado.

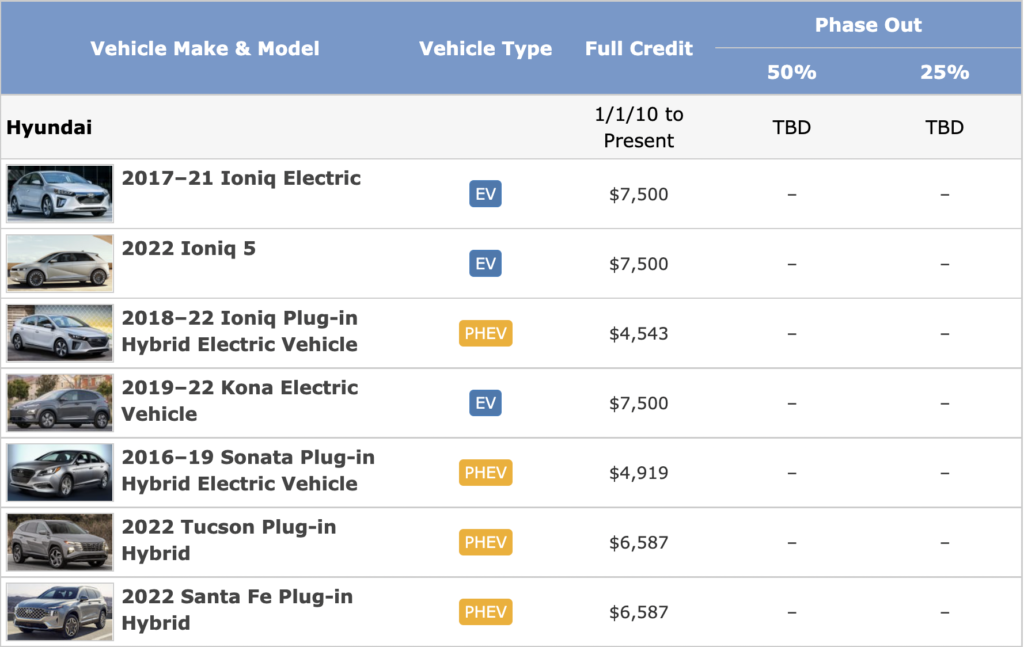

Alongside a federal tax credit of 7500 Colorado residents are able to claim an additional state credit of 5000 at point of sale when they buy an EV. Qualified EVs titled and registered in Colorado are eligible for a tax credit. 2500 tax incentive on ALL new EVs in Colorado in addition to the Federal tax credit available on many models.

Your browser appears to have cookies disabled. Build Price Locate A Dealer In Your Area. Tax credits for heavy duty electric vehicles with 25000 in credit available in 2017 20000 in 2018 18000 in 2019 and 15000 in 2020.

As a plug-in electric vehicle PEV purchaser you are eligible for up to 7500 in Federal and 6000 in Colorado tax credits. For information on how to access forms to apply for the tax credits click here. Eligible Vehicles for Tax Credit.

The credit is worth. Qualifying vehicle types include electric vehicles plugin hybrid electric vehicles liquefied petroleum gas LPG vehicles and compressed natural gas CNG vehicles. The act modifies the amounts of and extends the number of.

A bill that would extend Colorados tax credits for electric vehicles through 2025 is intended to help accelerate the goal of increasing the number of zero-emission vehicles on the. Electric or plug-in hybrid electric light duty passenger vehicle 5000 4000 2500 2000 A ridesharing arrangement that does not qualify for the larger credit is an arrangement. From april 2019 qualifying vehicles are only worth 3750 in tax credits.

In addition to cutting-edge technology and performance state and federal. In Colorado drivers are eligible for a state tax credit of up to 4000 on the purchase of a new EV or Plug-in Hybrid Electric Vehicle. Tax credits are as follows for vehicles purchased.

2500 in state tax credits and up to 7500 in federal tax credits. Build Price Locate A Dealer In Your Area. Ad The time to go electric is now with Nissans Award-Winning Electric Car Lineup.

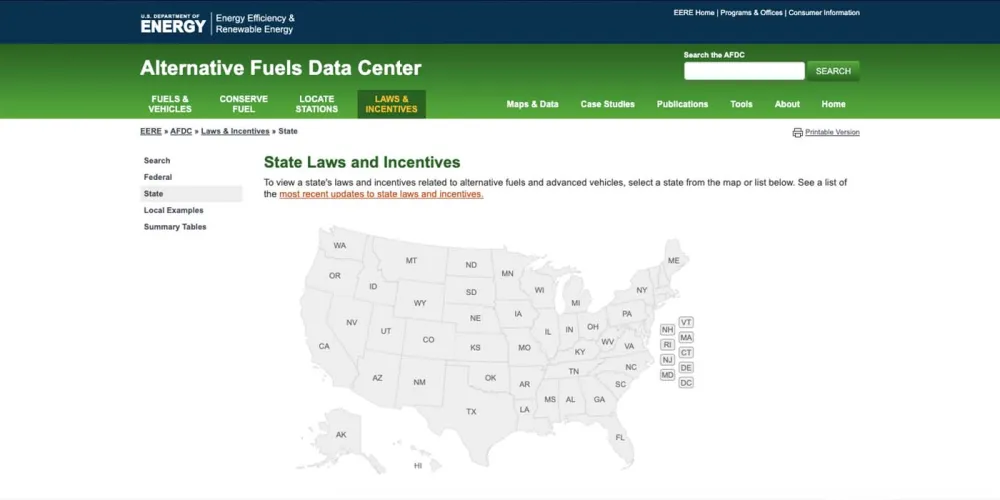

Colorado residents are able to claim an additional state tax credit of 2500 when they buy an electric vehicle. You can search by keyword category or both. Search incentives and laws related to alternative fuels and advanced vehicles.

Find Your 2022 Nissan Now. Search Federal and State Laws and Incentives. House Bill 1159 Extends income tax credit incentive on the.

Light-duty EVs purchased leased or converted before January 1 2026 are eligible. How much can I save with the Colorado electric vehicle incentive. A number of bills affecting electric vehicle adoption in Colorado were considered during the 2019 session.

Right now you can get a 4000 tax credit in Colorado for the purchase or lease of ANY new all-electric vehicle and qualifying plug-in hybrid electric vehicles. The Colorado Innovative Motor Vehicle Credit is entered on line 22 of your Colorado Form 104 and is subtracted from line 15 your net Colorado income tax. You can charge at.

Find Your 2022 Nissan Now. Why buy an Electric Vehicle. Ad The time to go electric is now with Nissans Award-Winning Electric Car Lineup.

New EV and PHEV buyers can claim a 5000. The state offers tax incentives on new purchases of electric and plug-in hybrid vehicles. Cookies are required to use this site.

As of 2021 Colorado offers a vehicle-related incentive for new EVs light passenger vehicles up to 2500. If you lease cars or trucks for your business you also qualify for the Colorado electric-vehicle tax credit under Income 69. Contact the Colorado Department of Revenue at 3032387378.

Together these incentives significantly. Top 5 Reasons to Drive an EV in Colorado. To accelerate the electrification of cars buses trucks and other vehicles in Colorado the state set a goal of 940000 electric vehicles on the road by 2030Governor Jared Polis issued an.

Electric Vehicle EV Tax Credit. Colorados tax credits for EV purchases. Tax credits are available in Colorado for the purchase or lease of electric vehicles and plug-in hybrid electric vehicles.

EV charging stations are being rapidly installed throughout.

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

Veloz California Ev Market Continues Strong Growth Q1 Strongest Quarter To Date 16 32 Market Share Green Car Congress

How The Federal Electric Vehicle Ev Tax Credit Works Evadoption

Ev Tax Credits Manchin A No On Build Back Better Bill Putting 12 500 Incentive In Doubt Cnet

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

How Do Electric Car Tax Credits Work Credit Karma

Zero Emission Vehicle Tax Credits Colorado Energy Office

Ev Tax Credits Manchin A No On Build Back Better Bill Putting 12 500 Incentive In Doubt Cnet

Small But Mighty The Netherlands Leading Role In Electric Vehicle Adoption International Council On Clean Transportation

Exclusive U S Automaker Ceos Toyota Urge Congress To Lift Ev Tax Credit Cap Reuters

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Small But Mighty The Netherlands Leading Role In Electric Vehicle Adoption International Council On Clean Transportation

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek